Family Affairs: Recognition, Child Support, Visitation, Inheritance etc.

更新日:2022年11月22日

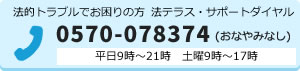

Please read them before using the service.

- The FAQ is a general introduction to the legal system in Japan and does not provide answers to specific individual questions.In addition, depending on your individual circumstances, the Japanese legal system may not be applicable.

- If you would like to know if there are any FAQs that are not listed here, or if you would like to discuss your specific needs, please contact the Multilingual Information Service (0570-078377). It will provide you with information on FAQs and consultation services based on the nature of your inquiry.

- Please note that Houterasu cannot be held responsible for any damages that may result from attempting to resolve specific individual problems based on the FAQ.

Contents

Recognition

Family Affairs etc

Child Support

- 05 I did not make an agreement regarding child support at the time of divorce. Can I still receive child support payments even if some time has passed

- since the divorce? If so, can I receive back payments of child support?

Visitation

Inheritance

- 16 I am a foreign national, but the year before last I married my Japanese spouse and we lived together. I had become accustomed to life in Japan and

- was living happily, but the other day, my spouse suddenly passed away. My current status of residence is “Spouse or Child of Japanese National.” Can I

- continue to live in Japan?

Q01: What is an “Action for Affiliation”?

![]()

- This is a procedure in which, in the event that the father does not agree to recognition of affiliation (paternity), legal recognition of such is granted by a family court.

(Explanation)

・An action for affiliation may be filed by a child born outside of marriage and their lineal descendants (children and grandchildren).

・If the party in question is still alive, a request for recognition conciliation must be made to a family court before filing a lawsuit. Even if the parties reach an agreement through conciliation, recognition of affiliation is not granted immediately, but only when the family court investigates the facts and finds that the agreement is reasonable.

・If no agreement can be reached through conciliation, an action for affiliation will be filed with the family court.

・An action for affiliation can be made at any time during the father’s lifetime, but after he dies, it must be made within three years of his death.

・If the blood relationship between the father and the child is proven in the action, the court will issue a judgment granting recognition of affiliation.

・In the case of an unborn child, the mother may file a petition for conciliation (conciliation requesting registration of recognition of the unborn child) against the father. However, the law is interpreted such that if the conciliation is unsuccessful, the mother may not file an action for recognition until after the birth.

00139

Q02: Can a child born to a Japanese father and a foreign mother who are not legally married acquire Japanese nationality?

![]()

- If the father acknowledges the child while the mother is pregnant (before the child is born), the child automatically acquires Japanese nationality from the time of birth.

- If the legal requirements are met, the child can acquire Japanese citizenship by notification.

- Even if the acquisition of nationality by notification is not approved, it is possible to apply for naturalization.

(Explanation)

・A child born between a man and a woman who are not legally married (a child born out of wedlock) acquires Japanese nationality from the time of birth if the father, who is a Japanese citizen, acknowledges the child before birth.

・A child born outside of marriage may acquire Japanese nationality upon submission of a notification of acquisition of nationality if all of the following legal requirements are met.

(1) They are under 18 years old (*) at the time of notification

(2) The father who acknowledged the child is a Japanese citizen at the time of the child’s birth

(3) The father who acknowledged the child is a Japanese citizen at the time of notification (or was a Japanese citizen at the time of death if the father died before notification)

・Notification of acquisition of nationality should be submitted to the Legal Affairs Bureau or the Regional Legal Affairs Bureau with jurisdiction over the place of residence if the address is in Japan, or to the Japanese diplomatic mission abroad if the address is overseas.

・For more information, consult the Legal Affairs Bureau, a Regional Legal Affairs Bureau, or a specialist such as a lawyer.

(*) Effective April 1, 2022, the condition in (1) has been changed from under 20 years old to under 18 years old. However, until March 31, 2024, it is possible to submit a notification of acquisition of nationality if the above conditions (2) and (3) are met as of April 1, 2022, and the individual in question is under 20 years old at the time of notification.

03069

Q03: I had an affair with a married person, and the spouse of my affair partner demanded compensation. Will this claim be approved?

![]()

- As a general rule, such claims for compensation will be approved. However, if it is recognized that your affair partner’s marriage had lost its substance at the time the affair began, or if you could not have known even with sufficient caution that your affair partner was married, then the claim for compensation will not be approved.

(Explanation)

・The act of having an affair with a married person is a tort against the spouse of the adulterous partner, and thus incurs an obligation to pay compensation.

・However, if the marriage between the adulterous partner and their spouse had already lost its substance at the time the affair began, then the claim for compensation will not be approved.

・This is based on the idea that the substantive relationship of marriage, which is entitled to legal protection, has been lost.

・In addition, if it was not possible to have known that the other party was married even with sufficient caution (e.g., the married affair partner misled the other party into believing that they were single), a tort will not result from the infringement on the marriage because there was no intentional or negligent behavior, and so a claim for compensation will not be approved.

00134

Q04: I am Japanese, can I adopt a child of foreign nationality?

![]()

- The Japanese Civil Code places no restrictions on the nationality of the adopted person, so it is possible to adopt a child of foreign nationality.

- However, it is important to note that even if you adopt a child of foreign nationality in a foreign country, it does not mean that the adopted child will automatically be granted residence status in Japan.

(Explanation)

・Adoption is governed by the laws of the home country of the prospective adoptive parents at the time of adoption, so when a Japanese person becomes an adoptive parent, the decision is based on the Japanese Civil Code. However, if the laws of the home country of the “person to be adopted” stipulate requirements for the protection of the adopted child (e.g., consent of the individual or a third party, permission of a public agency, etc.), such requirements must also be fulfilled.

・When a court’s involvement is required to finalize an adoption (for example, when adopting a minor or a special adoption), the family court in Japan can be used if either (or both) of the prospective adoptive parents or prospective adopted child live in Japan.

・As a general rule, a child of foreign nationality will be granted resident status in Japan in the following cases.

(1) The specially adopted child of a Japanese national: “Spouse or Child of Japanese National” status of residence

(2) A normally adopted child under six years of age who is supported by a Japanese adoptive parent: “Long-Term Resident” status of residence

(3) Adopted children of Japanese returnees from China (provided that they have been living with and receiving support from their adoptive parents since before they reached the age of six): “Long-Term Resident” status of residence

・A normally adopted child who is six years old or older may be granted “Long-Term Resident” status as a previous child of a foreign national if the adopted child is a minor and unmarried biological child supported by a foreign national residing in Japan with “Spouse or Child of Japanese National” status of residence.

・For more information, please consult with a lawyer or other specialist. It may be necessary to consult with lawyers, etc. in the relevant foreign country, so we recommend asking your lawyer, etc. whether this will be required.

00146

Q05: I did not make an agreement regarding child support at the time of divorce. Can I still receive child support payments even if some time has passed since the divorce? If so, can I receive back payments of child support?

![]()

- As long as the child is in need of support, a claim for child support can be made even after divorce.

- In some cases, the obligation to pay back payments of child support may be acknowledged, but it is up to the court to decide how far back the obligation can go if the parties are unable to negotiate or to reach an agreement. In practice, child support is often limited to the period after the time of the claim.

(Explanation)

・The obligation to pay child support arises from the parent-child relationship itself, regardless of whether or not the parent has parental authority or lives with a child. Even after divorce, as long as a child is in need of support, the parents are obligated to share the costs of child support.

・In the event that parents divorce without having made an arrangement regarding child support, the amount, timing, and method of payment will be determined through consultation between the parents. During this consultation, the interests of the child must be given the highest priority.

・If the parents are unable to negotiate or to reach an agreement, they will seek conciliation or an adjudication regarding child support payment from the family court. If a claim is made for back payments of child support, the family court will make a decision regarding child support, including from how far back payment should be made.

・If there is a specific time and amount of child support to be paid, the right to claim child support will be extinguished by prescription after five years have passed from the time of payment. However, back payments of child support in the absence of any agreement are not subject to the statute of limitations.

・Consult a lawyer for further details.

00106

Q06: We made an agreement on child support, but payments have not been kept up. What legal options are available to me?

![]()

- In cases where an agreement has been reached through conciliation or an adjudication, a recommendation of performance, an order of performance, and compulsory execution are available.

- If the agreement is made by a notarial deed with a statement of acknowledgment of compulsory execution, compulsory execution is available.

(Explanation)

・Payment cannot be legally enforced only on the basis of verbal or written agreements made between the parties. In this case, an application can be made to the family court for conciliation to request child support payments.

・If a conciliation or adjudication has already been conducted at a family court, there are two ways to secure payment of child support in accordance with the agreement: a request for a recommendation of performance, an order of performance filed with the family court, and a request for compulsory execution filed with the district court. If a notarial deed with a statement of acknowledgment of compulsory execution is prepared at a notary public office, only compulsory execution can be used.

・Please check with the family court where the conciliation or adjudication was conducted for the procedures regarding a recommendation of performance, an order of performance. For the procedures for compulsory execution, please check with the district court that has jurisdiction over the address of the other party (for compulsory execution of real estate, the district court that has jurisdiction over the location of the real estate).

・It is recommended to consult with a lawyer about which method to choose, the timing thereof, and other decisions that are relevant to your specific case.

00107

Q07: Is it possible to request a reduction in child support?

![]()

- If there are changes in personal or social circumstances that could not have been foreseen at the time the amount of child support was determined, and the current amount of child support no longer reflects the current situation, a reduction in the amount of child support can be requested.

(Explanation)

・The amount or method of support shall be determined in consideration of the need for support, the financial means of the person responsible for support, and all other circumstances.

・Once child support has been agreed upon or approved by adjudication, the family court may modify or revoke child support if there are unexpected changes in circumstances, such as a change in the financial circumstances of the parents or an increase in child support expenses.

・Changes in circumstances that were foreseeable to some extent even at the time the amount of child support was determined are not considered to be changes in circumstances that should change the amount of child support.

・Changes in circumstances that could not have been foreseen at the time the amount of child support was determined include unemployment due to the bankruptcy of the company where a parent works, extended hospitalization due to a parent’s illness or injury, or increased family living expenses after a parent remarries.

・If there is a change in circumstances as described above, a parent may request a reduction in child support through mutual agreement, conciliation, or an adjudication on the grounds that such a change constitutes a change in circumstances that requires a change in the amount of child support.

・If a child is adopted by another person, the adoptive parents will have the primary obligation to bear the costs of raising the child, and a request for a reduction may be granted.

・Consult a lawyer or other specialist for details.

00104

Q08: I would like to have visitation with my child(ren), what should I do?

![]()

- After divorce or while parents are living separately, matters concerning visitation with a child are to be decided through discussions between the parents. If the discussion does not go well, or if a parent is not allowed to have visitation as promised, the family court conciliation procedure can be used.

(Explanation)

・Visitation with a child should not be viewed from the perspective of the rights of the parents, but rather from the perspective the child’s welfare, with the best interests of the child being given the highest priority to avoid placing a burden on the child.

・The method of visitation should be as specific as possible in terms of frequency, time, and location.

・If the discussion does not go well, or if a parent is not allowed to have visitation as promised, a request for family court conciliation can be made. If conciliation is unsuccessful, an adjudication procedure will automatically be initiated, and the judge will make a decision on the method of visitation (“disposition regarding the custody of a child”), taking all the circumstances into consideration.

・Consult a lawyer for further details.

*When an international marriage breaks down and one parent removes a child from the marriage to their home country without the consent of the other parent, this can have a detrimental effect on the child due to the sudden and abrupt change to the child’s previous living arrangements. For more information on this issue, please refer to the FAQ on the Hague Convention (Convention on the Civil Aspects of International Child Abduction).

00116

Q09: My former spouse will not pay child support. Do I have to let my former spouse have visitation even if they do not pay child support?

![]()

- Child support payments and visitation are not provided on a quid pro quo basis. Therefore, it is not acceptable to refuse to allow visitation because of a lack of child support payments or to refuse to pay child support because of a lack of visitation.

- However, if the child support payments are not made without a valid reason, visitation may be restricted.

(Explanation)

・Both payment of child support and visitation are essential for the healthy upbringing of a child. Neither of these two are conducted on a quid pro quo basis — that is, the provision of one is not contingent on the provision of the other.

・Therefore, it is not acceptable to refuse to allow visitation because an former spouse does not pay child support payments or to refuse to pay child support to a former spouse because of a lack of visitation.

・However, there is a view that visitation should be restricted in cases where the child support is not paid without a valid reason, such as when the child support is not paid even though the parent in question has the financial means to do so. It is sometimes viewed as an abuse of rights to demand visitation while failing to fulfill the important parental responsibility of paying child support.

・Please consult with a lawyer for further details.

04677

Q10: What is an heir-at-law?

![]()

- Heirs defined by the Civil Code as able to be heirs are known as “heirs-at-law.”

(Explanation)

・There are two types of heirs-at-law: spouses and blood relatives.

・A spouse is always an heir.

・Blood relatives are ranked in order of precedence, and the first in line becomes the heir.

・The first in line are the children of the decedent. If a child is deceased, their heirs per stirpes (children, grandchildren, great-grandchildren, etc.)

・Second in line are lineal ascendants (parents, etc. of the decedent).

・Third in line are the decedent’s siblings. If a sibling is deceased, their heirs per stirpes (Limited to children. Grandchildren, great-grandchildren, etc. are not included)

00219

Q11: What are the procedures for dividing an estate?

![]()

- The following four procedures are available.

1. Division of an estate by will

2. Division of an estate mutual agreement between the heirs

3. Division of an estate by conciliation at family court

4. Division of an estate by family court adjudication

(Explanation)

・The division of an estate is the process of dividing a jointly inherited estate among the heirs.

・Since the scope of inheritance and heirs is determined only after inheritance starts, the only way for it to come into effect is through an agreement reached by the heirs after the start of inheritance. Therefore, an agreement on the division of an estate before the start of inheritance (during the lifetime of the decedent) is invalid.

・If the joint heirs are unable to reach an agreement on the division of the estate, or if they are unable to negotiate, each heir may apply to the family court for conciliation or an adjudication.

・Conciliation is a procedure to determine the method of division through discussion with a domestic relations conciliation commissioner.

・An adjudication is a procedure in which the court makes a binding decision on how to divide an estate.

・Although it is possible to make a request for a trial from the outset, it is common to first file a request for conciliation prior to an adjudication.

・The request for conciliation is made to the family court at the address of another party (one of the joint heirs) or to a family court agreed upon by the parties.

・A request for adjudication is made to the family court that has jurisdiction over the place where the inheritance started (the last place of residence of the decedent) or to a family court agreed upon by the parties.

00264

Q12: I found the will of a deceased family member. What should I do about the inheritance procedures?

![]()

- You will need to file a petition for probate of the will with a family court.

- Depending on the contents of the will, it may be necessary to appoint an executor.

(Explanation)

・With the exception of notarized wills, when the custodian of the will learns of the start of inheritance, or when an heir discovers the will, they must promptly submit it to the family court and request probate of it.

・In particular, with the exception of notarized wills, a will cannot be used as an attachment for the registration of real estate unless it has been probated by a family court.

・Wills kept at a Legal Affairs Bureau after the effective date of the Act on Storage of Wills in Legal Affairs Bureau (Act on the Storage of Wills) (July 10, 2020) do not need to be probated.

・The probate process only verifies the will and does not determine its validity, such as the truth of its contents. Therefore, disputes about the validity or invalidity of the will will be decided in court.

・Implementing the terms of a will, such as bequests of property, removal of presumed heirs, and recognition of affiliation requires the act of an executor. If the will does not provide for an executor, a request will be made to the family court to appoint one.

00289

Q13: What sort of procedure is renunciation of inheritance?

![]()

- Renunciation of inheritance is a declaration of intent by an heir to refuse to assume the rights and duties of the decedent, and is a procedure conducted at family court.

(Explanation)

・Renunciation of inheritance is granted by submitting a written request to the family court with jurisdiction over the decedent’s last known address within three months of learning of the start of inheritance, and having the request accepted. However, the law is interpreted such that a formal acceptance does not confirm the validity of the renunciation, and if there is a legal cause for invalidation, the validity can be challenged later in a lawsuit.

・If a decision cannot be made within three months, a petition for extension of the time limit can be filed with the family court.

・If a claim is made by a creditor some time after the start of the inheritance and the existence of the decedent’s debt is known for the first time at that time, a renunciation of inheritance may be permitted even if three months have passed since the start of the inheritance.

・If a person renounces their inheritance, they are deemed never to have been an heir in the first place. The lineal descendants (children, grandchildren, etc.) of the person who renounces an inheritance will not be entitled to inheritance per stirpes.

・Upon renunciation of inheritance, the person next in line in the legal order of succession becomes the heir. For example, if all the decedent’s children renounce their inheritance, the lineal ascendants (parents, etc.) become the heirs. In addition, if all lineal ascendants renounce the inheritance, the decedent’s siblings become the heirs. In addition, the spouse of the decedent is always an heir.

・If the inheritance is insolvent, all of these people must renounce their inheritance in order to avoid the debt.

00210

Q14: When should renunciation of inheritance be performed by?

![]()

- Renunciation of inheritance should be performed within three months from the time you became aware that inheritance had started on your behalf. This is known as the “deliberation period.”

(Explanation)

・“The time you became aware that inheritance had started on your behalf” is when you learn of the death of the decedent (the person who died). However, in the case of a person who becomes an heir due to renunciation by someone higher in the order of precedence (e.g., the decedent’s parents become heirs because the decedent’s children renounce inheritance), this is the time when you also become aware of the renunciation by the person higher in the order of precedence.

・Within the deliberation period, a written request for renunciation of inheritance should be submitted to the family court that has jurisdiction over the decedent’s last known address. If the request is accepted by the family court, the renunciation of inheritance is granted.

・If there is more than one heir, the three-month deliberation period will proceed separately for each heir.

・In addition to the heirs themselves, this three-month period of deliberation may be extended at the request of interested parties (e.g., creditors of the heirs, heirs next in order of precedence, creditors and debtors of the decedent).

・Even if three months have passed from “the time you became aware that inheritance had started on your behalf,” you may still be able to make a request for renunciation of inheritance in exceptional cases.

・There is a precedent rendered by the Supreme Court saying that if there are reasonable grounds for believing that there is no inheritance at all, including debts and other liabilities, the three-month period of deliberation should be counted from the time when the heir became aware of the existence of all or part of the inheritance, or from the time when the heir would normally become aware of it.

00212

Q15: A foreign national who has lived in Japan for many years has died, leaving behind property in Japan. How do I proceed with the inheritance process?

![]()

- If the decedent, a foreign national, was living in Japan at the time of death, the procedures can be carried out at a Japanese court (family court).

- As a general rule, the decision will be based on the laws of the decedent’s home country, but there are cases where the decision will be based on Japanese law (the Japanese Civil Code).

(Explanation)

・The issues of international jurisdiction, i.e., which country’s courts can proceed with the proceedings, and of governing law, i.e., which country’s laws should govern the decision, may arise.

<<International jurisdiction>>

・If the decedent was living in Japan at the time of death, a Japanese court (family court) will have jurisdiction over the renunciation of inheritance.

・If the decedent was living in Japan at the time of death, or if the heirs have agreed to divide the estate in a Japanese court, a Japanese court (family court) will have jurisdiction over the division of the estate.

・However, in cases where there is also an estate in a foreign country, the question arises of whether an inheritance based on a conciliation or adjudication regarding the division of an estate that was concluded in Japan can be executed in a foreign country. It is necessary to carefully consider whether or not it is appropriate to proceed with the division of estate in a Japanese court (family court).

<<Governing law>>

・According to Japan’s private international law (Act on General Rules for Application of Laws), inheritance is governed by the law of the decedent’s home country, and therefore the law of a foreign decedent’s home country is the governing law. For example, if the foreign decedent was a national of the Republic of Korea, as a general rule, Korean law (the Civil Code of the Republic of Korea) will be the governing law.

・In some cases, however, the private international law of the decedent’s home country may have different provisions, and Japanese law (the Civil Code of Japan) will be the governing law. For example, according to China’s private international law (Act of the People’s Republic of China on Application of Law in Civil Relations with Foreign Contacts), “the law of the location of the real estate shall apply to legal inheritance of real estate.” Therefore, if a foreigner of Chinese nationality dies without making a will, Japanese law (Japanese civil law) will be the governing law regarding inheritance of real estate located in Japan.

・As described above, inheritance issues with international elements are complex, so please consult with a lawyer or other specialist. It may be necessary to consult with lawyers, etc. in the relevant foreign country, so we recommend asking your lawyer, etc. whether this will be required.

03076

Q16: I am a foreign national, but the year before last I married my Japanese spouse and we lived together. I had become accustomed to life in Japan and was living happily, but the other day, my spouse suddenly passed away. My current status of residence is “Spouse or Child of Japanese National.” Can I continue to live in Japan?

![]()

- When a person living with you or a relative dies, you must submit a notification of death to the municipal government within seven days of the date of death.

- In addition, if your Japanese spouse dies, you are no longer a “Spouse or Child of Japanese National” and must notify a regional immigration bureau within 14 days.

- If you wish to continue living in Japan, you will need to change your status of residence to one that you believe you meet the requirements for within six months of your spouse’s death.

(Explanation)

・If the Japanese spouse of a foreign national residing in Japan with the status of “Spouse or Child of Japanese National” dies, the foreign national is required to notify the Minister of Justice within 14 days of the spouse’s death, either by appearing at a regional immigration bureau or sending a notification by mail to the Tokyo Regional Immigration Bureau. Failure to do so may result in the loss of your status of residence, so please take due care.

・If you wish to continue staying in Japan, you must apply for a change of status of residence within six months.

・If you have been living in Japan for a long time (e.g., married for more than three years) and have a solid foundation for your livelihood, you may be able to change your status of residence to “Long-Term Resident,” but in this case, since you have been living in Japan for less than three years, it would be difficult to change your status of residence and continue living in Japan.

・However, if you meet certain requirements, such as having children with your deceased husband and needing to support them, you will be allowed to change your status of residence to that of “Long-Term Resident.”

・If there are other unavoidable circumstances, please consult with the Immigration Bureau.

03803